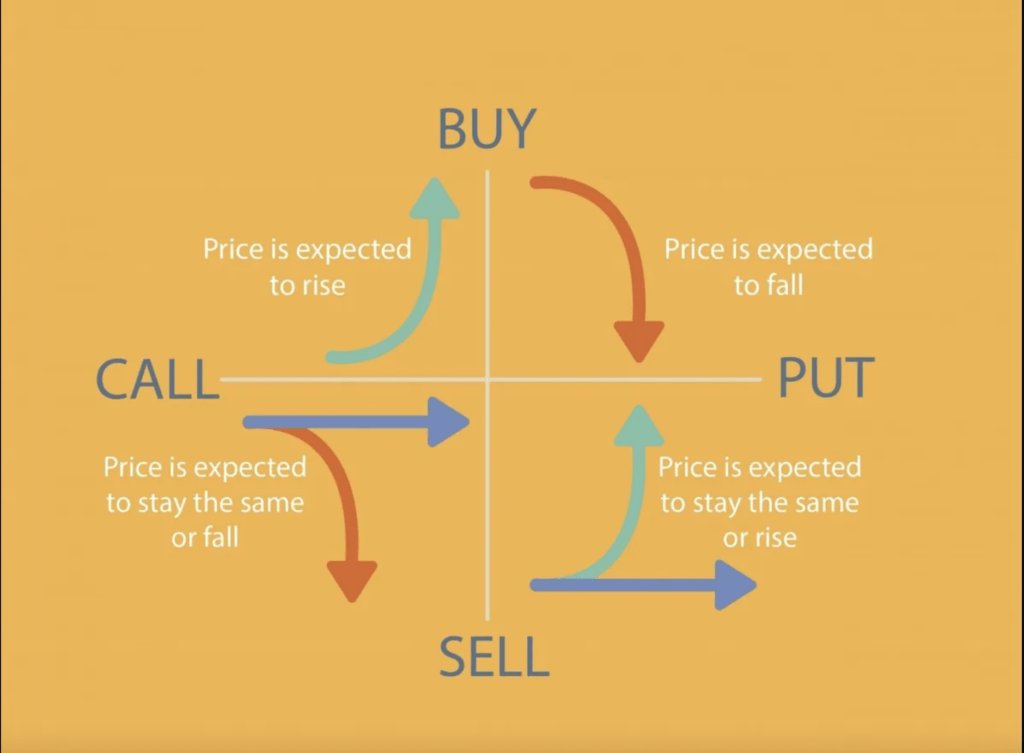

This is a neutral bullish strategy and going to be the upside bounce in order to collect the premium.

Sell ATM Put and Buy OTM Put = Sell Put + Buy Put

Sell 50 Delta & Buy 25 Delta

Use 45 days To Expiration. The characteristic is 50% higher profit with the negative of R&R.

To collect at least 33% of the vertical width !!! Another advance similar strategy is short strangle in which sell 30 delta Call & sell 15 delta Put.

Do you want to setup your Casino and start earning interest rates? Follow me to read on

-

1970 Switzerland / Helvetia 1/2 Fr Coin$20.00

1970 Switzerland / Helvetia 1/2 Fr Coin$20.00 -

Liberty Quarter Dollar 1970 USA$2,000.00

Liberty Quarter Dollar 1970 USA$2,000.00 -

Elizabeth II DG reg fd 2003 one Pound coin$22.00

Elizabeth II DG reg fd 2003 one Pound coin$22.00 -

Malaysia Ringgit 1 Coin 1971$50.00

Malaysia Ringgit 1 Coin 1971$50.00 -

DGM Affiliates Program$1.00

DGM Affiliates Program$1.00 -

Emails | Domain Migration Full Stack Development$79.00

Emails | Domain Migration Full Stack Development$79.00 -

Futures and Options Trading Strategies$1,971.00

Futures and Options Trading Strategies$1,971.00