Terms & Conditions

Last updated: September 29, 2025

1. Introduction

Welcome to DailyGameMoments ("we," "our," or "us"). These Terms and Conditions govern your use of our quantitative trading services, algorithms, and related products (collectively, the "Services"). By accessing or using our Services, you agree to be bound by these Terms and all applicable laws and regulations.

Our quantitative trading system is designed to automatically manage position sizing based on market volatility and volume. However, you retain full responsibility for selecting appropriate leverage levels based on your risk tolerance and financial capacity.

You will be running algorithmic trading bots developed and maintained by DailyGameMoments through our system. These bots can be deployed using your personal exchange accounts or supported centralized platforms (e.g., Bybit), and they operate based on our proprietary quantitative models and auto-sizing logic.

You are solely responsible for configuring and managing these bots, including setting leverage levels, assessing strategy fit, and supervising trading outcomes based on your own preferences and constraints.

2. Risk Disclosure

Trading in financial markets involves substantial risk of loss and is not suitable for all investors. Our Services utilize mathematical models and algorithms to execute trades, but past performance is not indicative of future results. You acknowledge and agree that:

- You understand the risks associated with trading and are solely responsible for any losses incurred.

- You have sufficient knowledge and experience in trading to evaluate the merits and risks of our Services.

- You are financially able to bear the risk of loss associated with trading activities.

- You understand that leverage magnifies both potential profits and potential losses.

"Large capital protects against volatility, but leverage multiplies folly." — Adapt wisely.

Performance Metrics

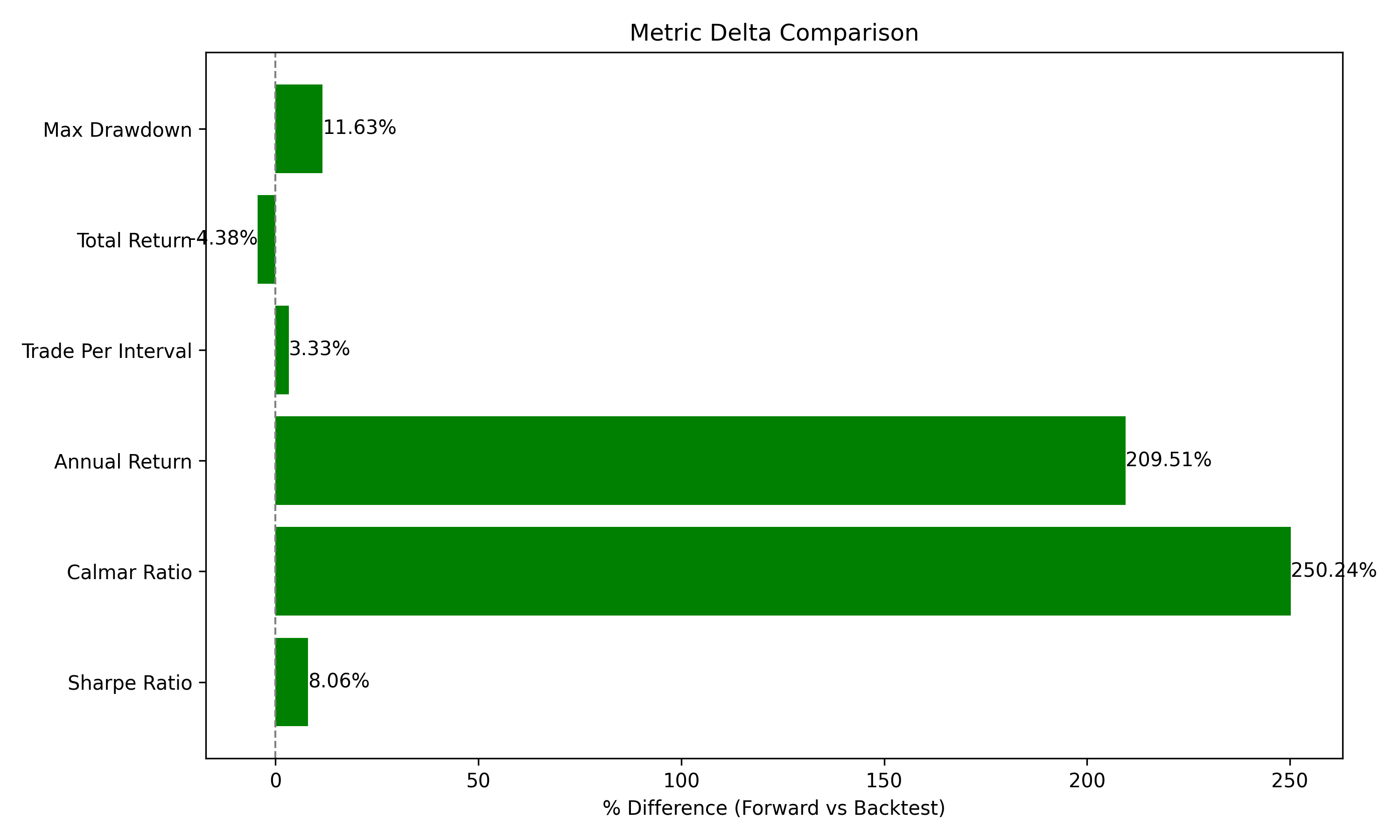

| Metric | Backtest | Forward Test | Delta | Status |

|---|---|---|---|---|

| Sharpe Ratio | 10.17 | 10.99 | 8.06% | PASS |

| Calmar Ratio | 82.34 | 288.39 | 250.24% | PASS |

| Annual Return | 29.58% | 91.56% | 209.51% | PASS |

| Trade Per Interval | 0.03 | 0.031 | 3.33% | PASS |

| Total Return | 5.0283 | 4.8079 | 4.38% | PASS |

| Max Drawdown | -35.93% | -31.75% | 11.63% | PASS |

Evaluation Checks

Overfitting Test

Trade Count

Metric Delta Visualization

Visual representation of key metric deltas between backtest and forward test results

Leverage Risk Profile

Leverage Recommendations

- Use 1x leverage for core capital preservation

- Allocate small portion to higher leverage (5x-10x) if seeking aggressive growth

- Implement dynamic leverage based on market volatility

- Set hard position size limits (max 5% per trade)

- Consider hedging strategies for leverage positions

Risk Management Strategies

Position Sizing

- Automatically adjusted based on market volatility

- Volume-based scaling algorithm

- Max position size capped at 10% of capital

Hedging Techniques

- Options-based hedging for leveraged positions

- Correlation-based portfolio diversification

- Volatility-targeted position reduction

Circuit Breakers

- Daily loss limit: 5% of capital

- Position liquidation at 40% drawdown with the leverage of 1x

- Market condition monitoring with auto-adjustments

4. System Limitations

Our quantitative trading system has the following characteristics and limitations:

- Auto Position Sizing: Automatically adjusts position sizes based on market volatility and volume.

- Leverage Responsibility: You are solely responsible for determining and applying leverage.

- Forward Testing Variance: Live performance may differ from backtest results due to changing market conditions.

- Execution Risk: Trade execution may be impacted by slippage, liquidity issues, or technical disruptions.

Important Considerations:

- The reported Max Drawdown (MDD) — -35.93% in backtests and -31.75% in forward tests — includes auto-sizing logic as part of system operation.

- Leverage scales both returns and drawdowns. For example, 10x leverage could increase MDD to ~300% or more.

- Forward test discrepancies (e.g., lower Trade Per Interval) suggest that auto-sizing may not fully mitigate live market variance.

5. Practical Workarounds

If you wish to use higher leverage while managing risk, consider these approaches:

- Cap Position Sizing: Enforce a strict limit (e.g., 5% of capital per trade).

- Dynamic Leverage: Apply leverage selectively when volatility is low.

- Separate Capital Pools: Maintain conservative and aggressive accounts separately.

- Hedging: Use options or negatively correlated assets to offset risk.

Final Recommendation:

- For ~40% MDD tolerance, use 1x–5x leverage, even with auto-sizing.

- For extreme leverage (e.g., 50x–100x), redesign strategies to target <5% unleveraged MDD or isolate small capital allocations.

6. User Responsibilities

By using our Services, you agree to:

- Set leverage according to your financial situation and risk tolerance.

- Regularly monitor and manage your accounts.

- Maintain adequate capital reserves for losses and margin requirements.

- Understand that automated sizing reduces but does not eliminate risk.

- Abide by all applicable laws and exchange regulations.

To enable automated trading, you will be required to provide your Bybit API key and secret to connect your account to our system. These API keys must have "trade-only" permissions — meaning they allow DailyGameMoments to execute orders on your behalf, but do not permit withdrawals, transfers, or access to your funds.

DailyGameMoments will never request, require, or accept API keys with withdrawal rights. Your funds remain in your custody at all times.

7. Limitation of Liability

To the maximum extent permitted by law, DailyGameMoments shall not be liable for any:

-

Trading losses or lost profits.

Example: If the bot enters a trade and the market crashes, causing you to lose money — that's your responsibility. -

Indirect, incidental, special, consequential, or exemplary damages.

Example: If a bad trade ruins your vacation budget or causes other financial domino effects — we're not responsible. -

Loss of data, goodwill, or other intangible harm.

Example: If your strategy results get deleted by mistake, or you lose client trust while using our service — we can't be held liable. -

System errors, connectivity interruptions, or exchange-side failures.

Example: If Bybit goes down during a crucial trade, or our servers temporarily disconnect — we can't be blamed for the outcome.

8. Changes to Terms

We may revise these Terms at any time. Material changes will be announced via email or the website. Continued use of the Services implies acceptance of the revised Terms.

9. Disclaimer

The content, tools, and algorithms provided by DailyGameMoments are for informational and educational purposes only. They do not constitute financial, investment, or trading advice.

DailyGameMoments is not a licensed financial advisor, broker, or dealer. Use of our Services does not establish a fiduciary relationship.

All trading decisions made using our system, bots, metrics, or recommendations are undertaken at your sole discretion and risk. You are fully responsible for evaluating the suitability of any strategy based on your personal financial situation.

We strongly recommend seeking advice from a qualified financial professional before making any investment decisions.

10. No Refunds Policy

ALL SALES ARE FINAL. NO REFUNDS WILL BE ISSUED UNDER ANY CIRCUMSTANCES.

By purchasing any of our services, products, or subscriptions, you acknowledge and agree that:

- All payments are non-refundable once the service has been accessed, downloaded, or utilized in any manner

- No refunds will be provided for dissatisfaction with performance results, trading outcomes, or strategy effectiveness

- No refunds will be granted for technical issues, connectivity problems, or exchange-related disruptions

- No refunds will be issued for changes in market conditions, volatility, or economic factors affecting trading performance

- No refunds will be provided for user error, misconfiguration, or improper use of our systems and algorithms

- No refunds will be granted for partial use or non-use of purchased services

IMPORTANT: Our services provide access to quantitative trading algorithms and educational resources. We do not guarantee specific financial results or trading performance. All trading involves risk, and past performance does not guarantee future results. You are solely responsible for your trading decisions and outcomes.

By completing your purchase, you explicitly acknowledge that you have read, understood, and agreed to this no-refunds policy. You confirm that you are purchasing our services with the understanding that all sales are final and non-refundable.