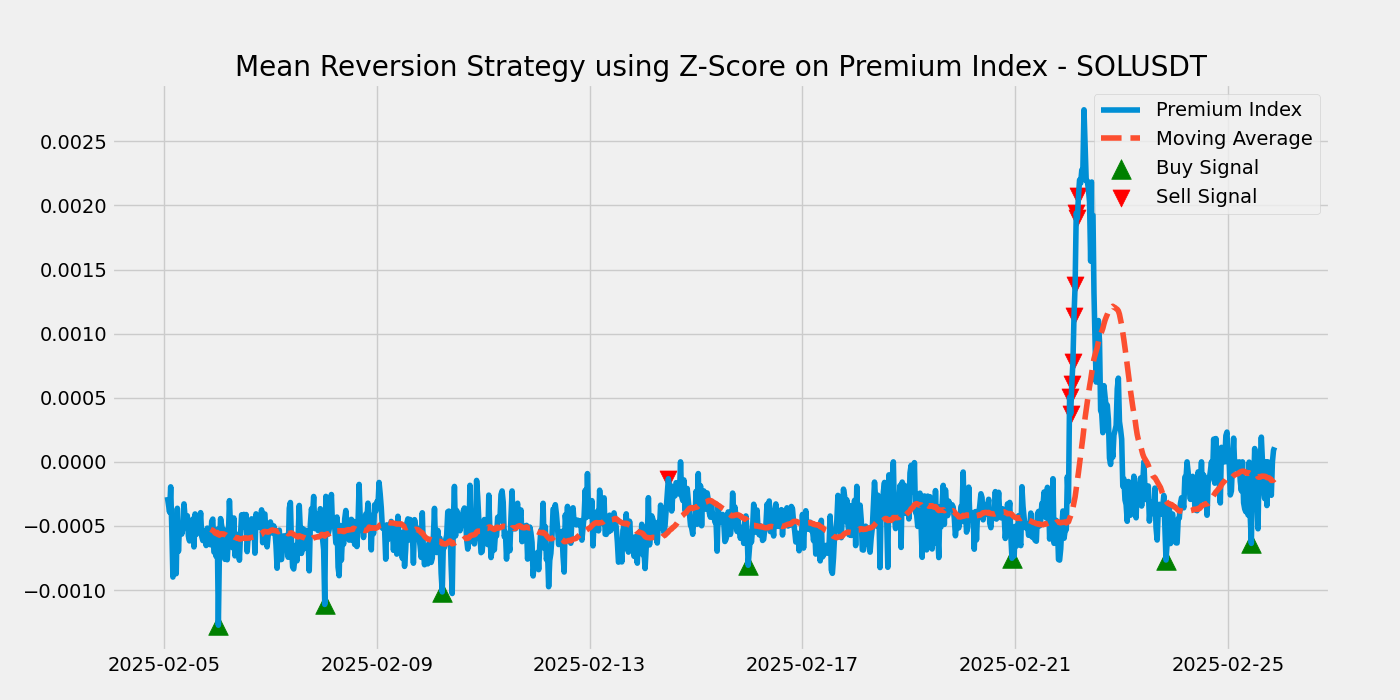

Mean Reversion strategies are based on the idea that prices and other financial metrics tend to revert to their historical mean or average level over time. Using the Z-Score in a mean reversion strategy helps identify when the premium index is significantly deviating from its historical mean, signaling potential trading opportunities.

Mean Reversion Strategy Using Z-Score on Premium Index

Here’s a step-by-step guide to implementing a mean reversion strategy using the Z-Score of the premium index:

1. Fetch and Prepare Historical Data:

Retrieve historical premium index data from your source (API, database, etc.).

2. Calculate Mean and Standard Deviation:

Compute the mean and standard deviation of the historical premium index values.

3. Calculate Z-Score:

Determine the Z-Score for the current premium index value using the historical mean and standard deviation.

4. Define Trading Signals:

Based on the Z-Score, create rules to generate buy or sell signals:

- Buy Signal: When the Z-Score is below a certain threshold (e.g., -2), indicating the premium index is significantly below the mean and might revert upwards.

- Sell Signal: When the Z-Score is above a certain threshold (e.g., 2), indicating the premium index is significantly above the mean and might revert downwards.