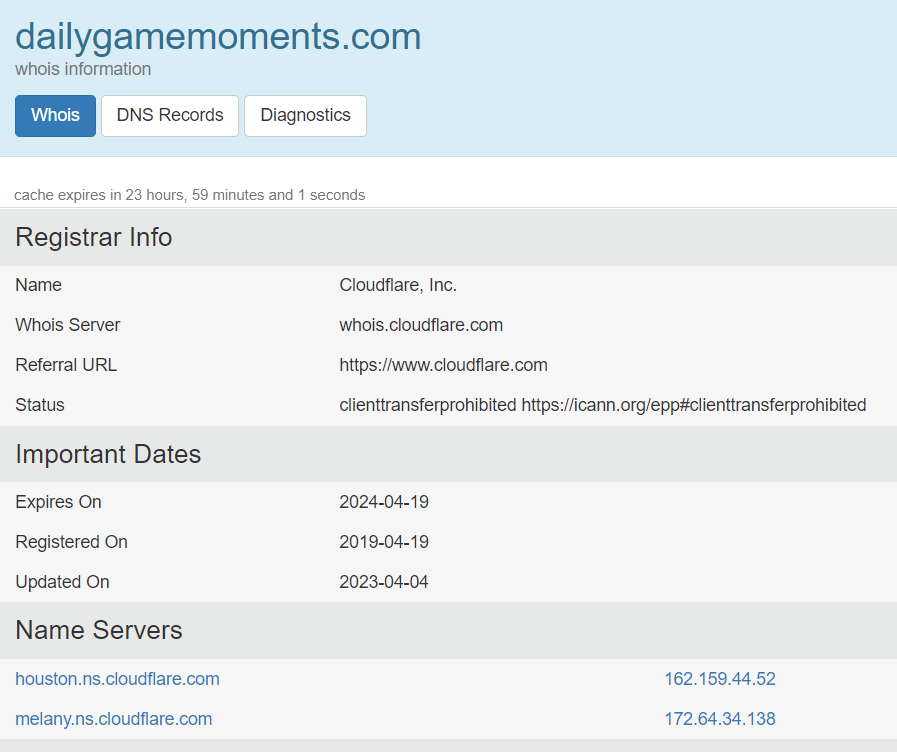

- Free VPN by Cloudflare (DNS)

- 3 SOP In Trading

- 2024 Building A Strong Heart With Quant Trading

- 2024 Building A Strong Heart With AI

- 2024 December Achievements

- Happy Achievements

Introduction

Hey there, fellow investors and adventure seekers! Today, we’re diving into the fascinating world of options trading. Whether you’re an experienced trader or just getting started, options trading can be a game-changer that adds a whole new level of excitement to your investment journey.

What are Options?

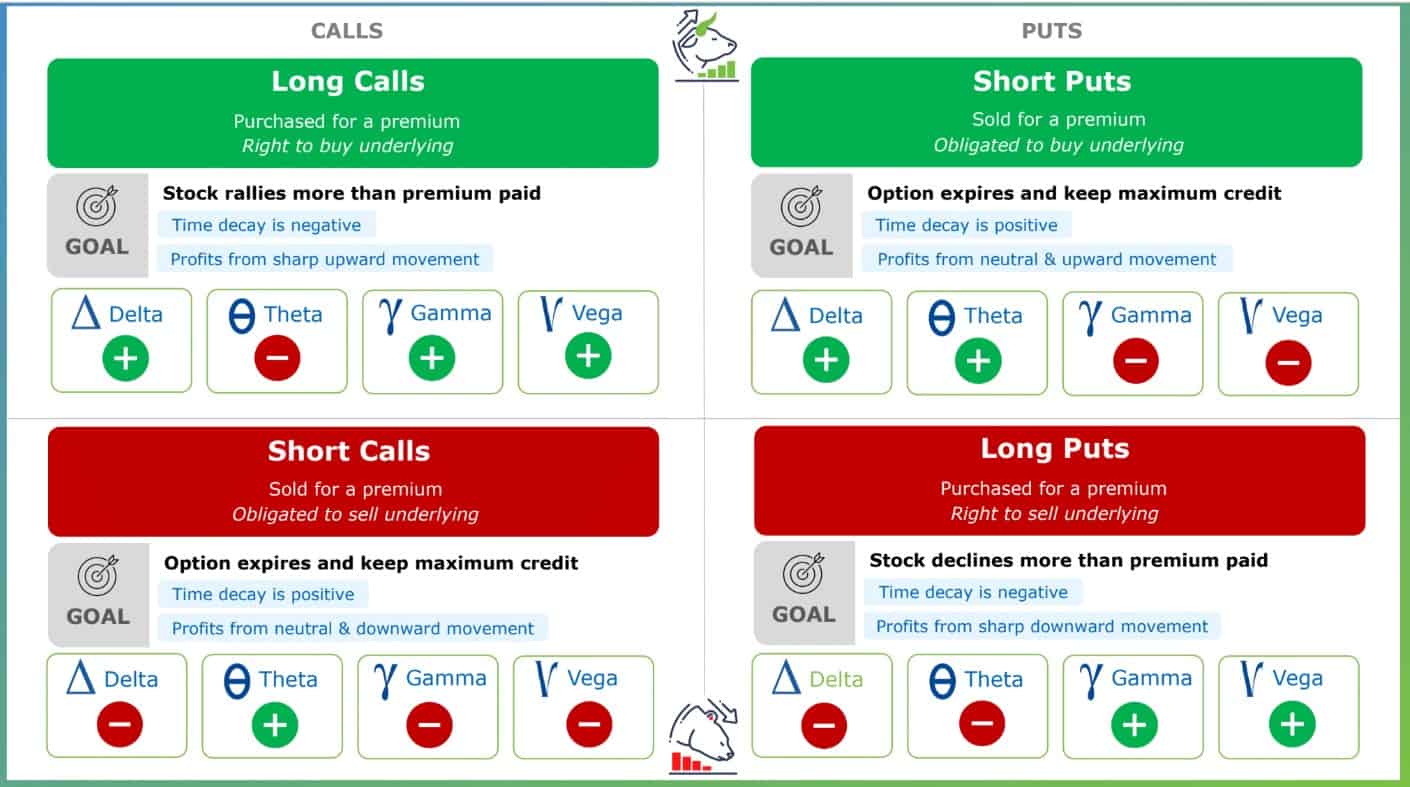

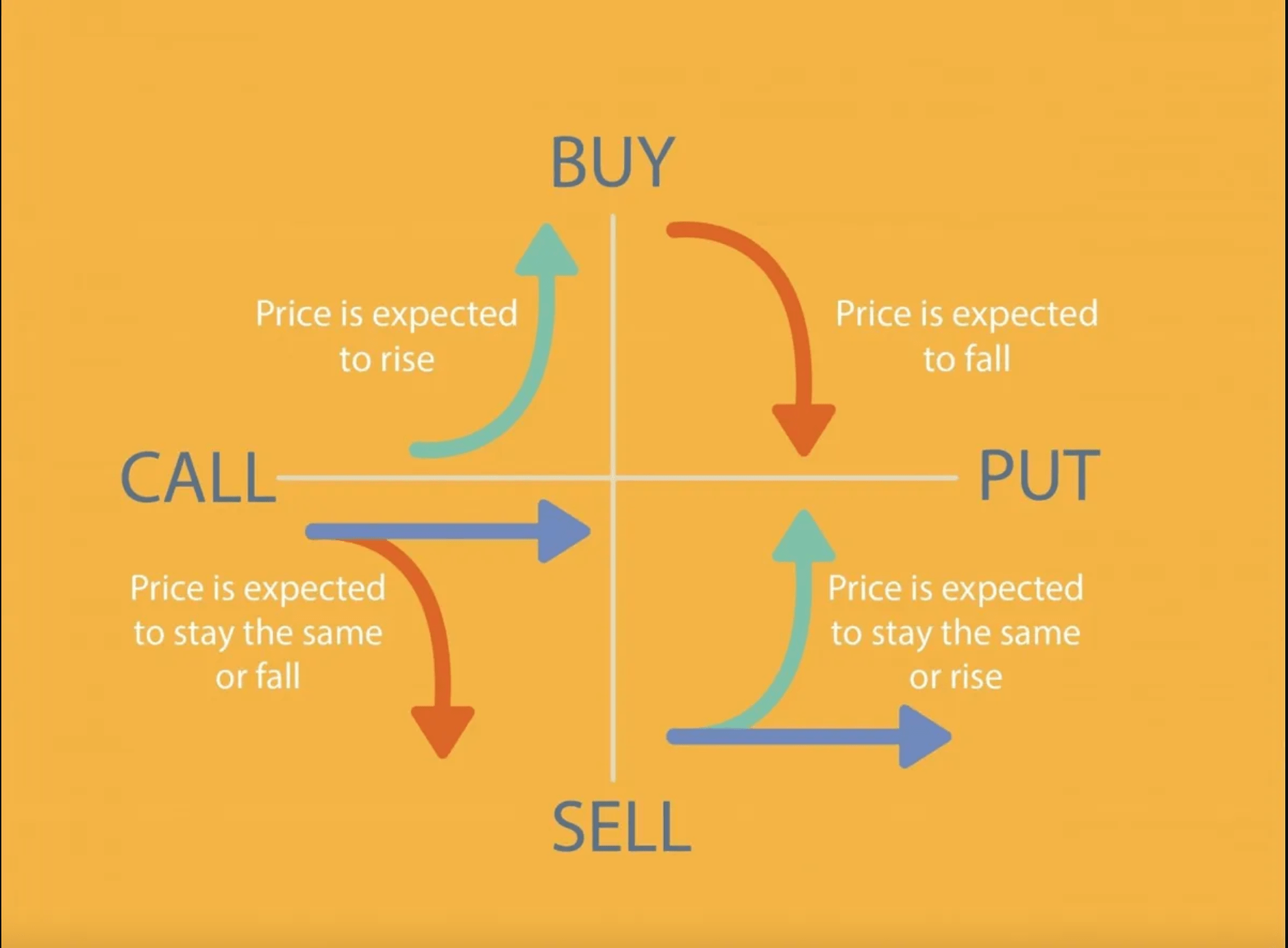

To put it simply, options are a type of financial derivative that give you the right (but not the obligation) to buy or sell an underlying asset (like stocks, commodities, or currencies) at a predetermined price within a specified time frame. Think of it as a special kind of contract that allows you to speculate on the future price movement of an asset.

The Game-Changing Power of Options Trading

1. Flexibility and Diversification

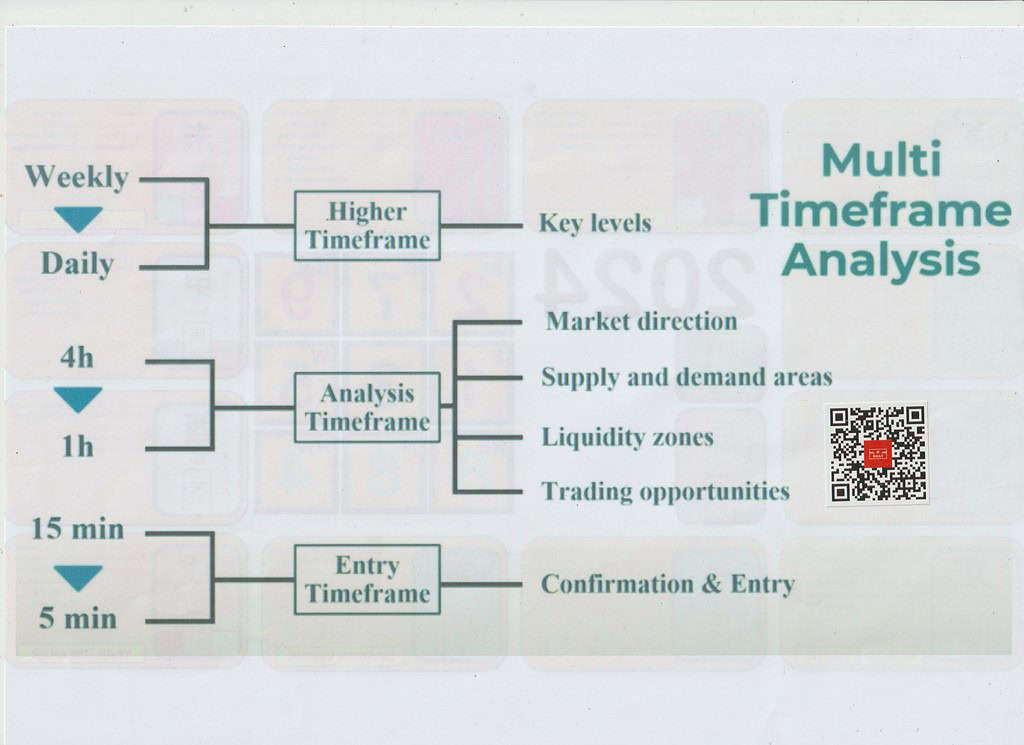

One of the key advantages of options trading is its flexibility. Unlike traditional stock trading, options provide you with a vast array of strategies to choose from. Whether you want to hedge your existing positions, generate income, or speculate on market direction, options can be tailored to suit your unique investment style and risk tolerance.

Options also offer a great opportunity to diversify your portfolio. By using options contracts on various assets, you can spread your risk and potentially increase your chances of success. It’s like having a game plan for different market scenarios, allowing you to adapt and thrive in changing conditions.

2. Limited Risk, Unlimited Potential

Options trading can be a powerful tool for risk management. When you buy an option, your risk is limited to the premium you paid for it. This means you can control a larger number of shares for a fraction of the cost compared to buying the underlying asset outright. It’s a bit like playing a game with a safety net – you have the potential to score big, but your downside is limited.

Moreover, options offer unique profit potential. With the right strategy, you can magnify your gains and generate significant returns. You can even profit from market moves in any direction, whether the price goes up, down, or sideways.

Getting Started

Now that we’ve piqued your interest, you’re probably wondering how to get started with options trading. Here are a few steps to guide you on your journey:

1. Educate Yourself: Options trading can seem complex at first, so take the time to learn the basics. There are plenty of online resources, courses, and books available to help you understand the ins and outs of this exciting investment strategy.

2. Open an Account: Find a reputable brokerage platform that offers options trading. Look for one that suits your needs, offers educational resources, and provides a user-friendly interface.

3. Start Small: Begin with a virtual or paper trading account to practice your strategies and get a feel for the market. This will help you build confidence and refine your skills without risking real money.

4. Develop a Strategy: Determine your goals, risk tolerance, and preferred trading style. Experiment with different options strategies and find the ones that align with your objectives.

5. Stay Informed: Keep up with market news, economic indicators, and company announcements that may affect the assets you’re trading. This will help you make more informed decisions and adapt your strategies accordingly.

Conclusion

Options trading may not be for everyone, but it certainly adds a thrilling twist to your investment journey. With its flexibility, limited risk, and unlimited potential, it’s no wonder why many traders find options to be a game-changer. If you’re up for the challenge and willing to put in the effort to learn, options trading can be a valuable addition to your investment arsenal.

Remember, like any game, it takes practice, discipline, and continuous learning to succeed. So, grab your joystick and dive into the exhilarating realm of options trading – the game where you call the shots and unlock your investment potential!

Here To Trade Options From Experts With Best Wins And 100% FREE!!!