Tag: DGM Winning Trades

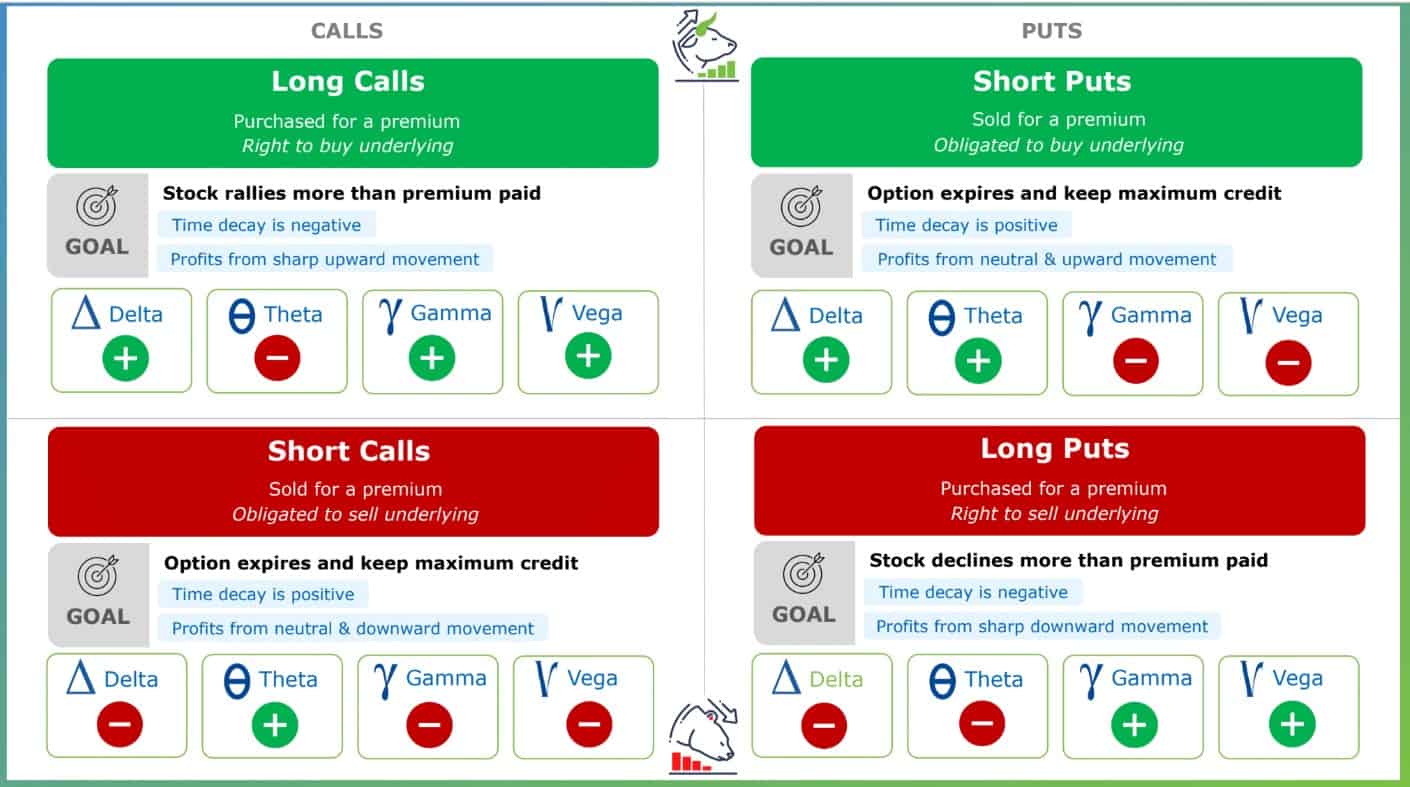

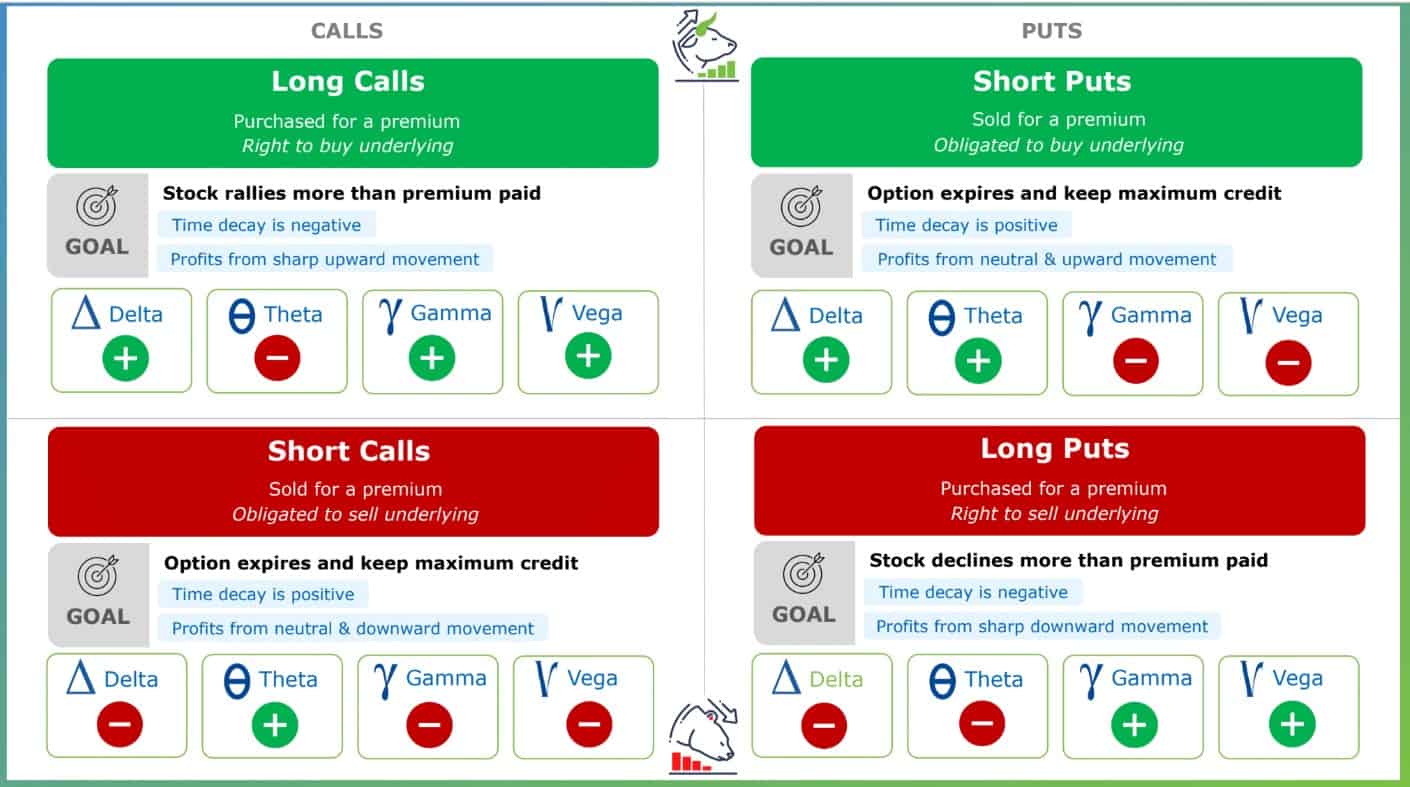

Protected: Steps In Options Trading

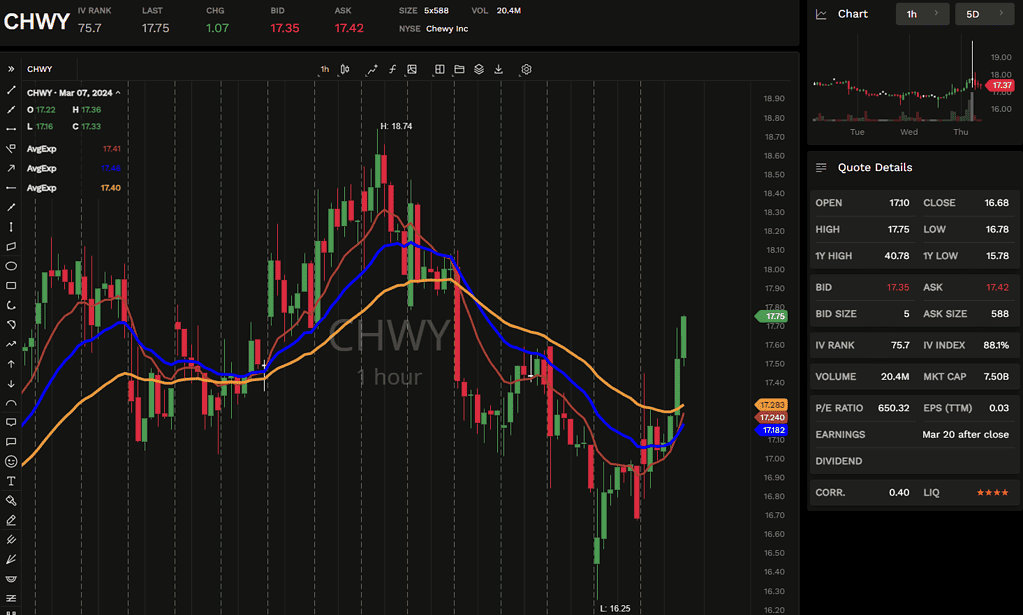

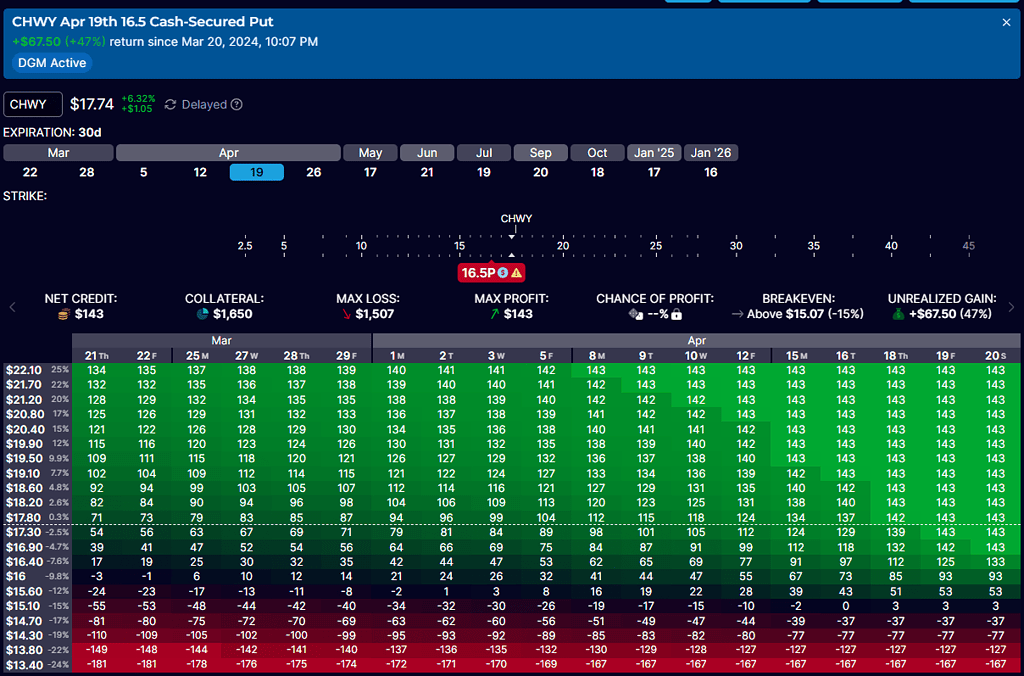

CHWY Sell Put Options Again in March 2024

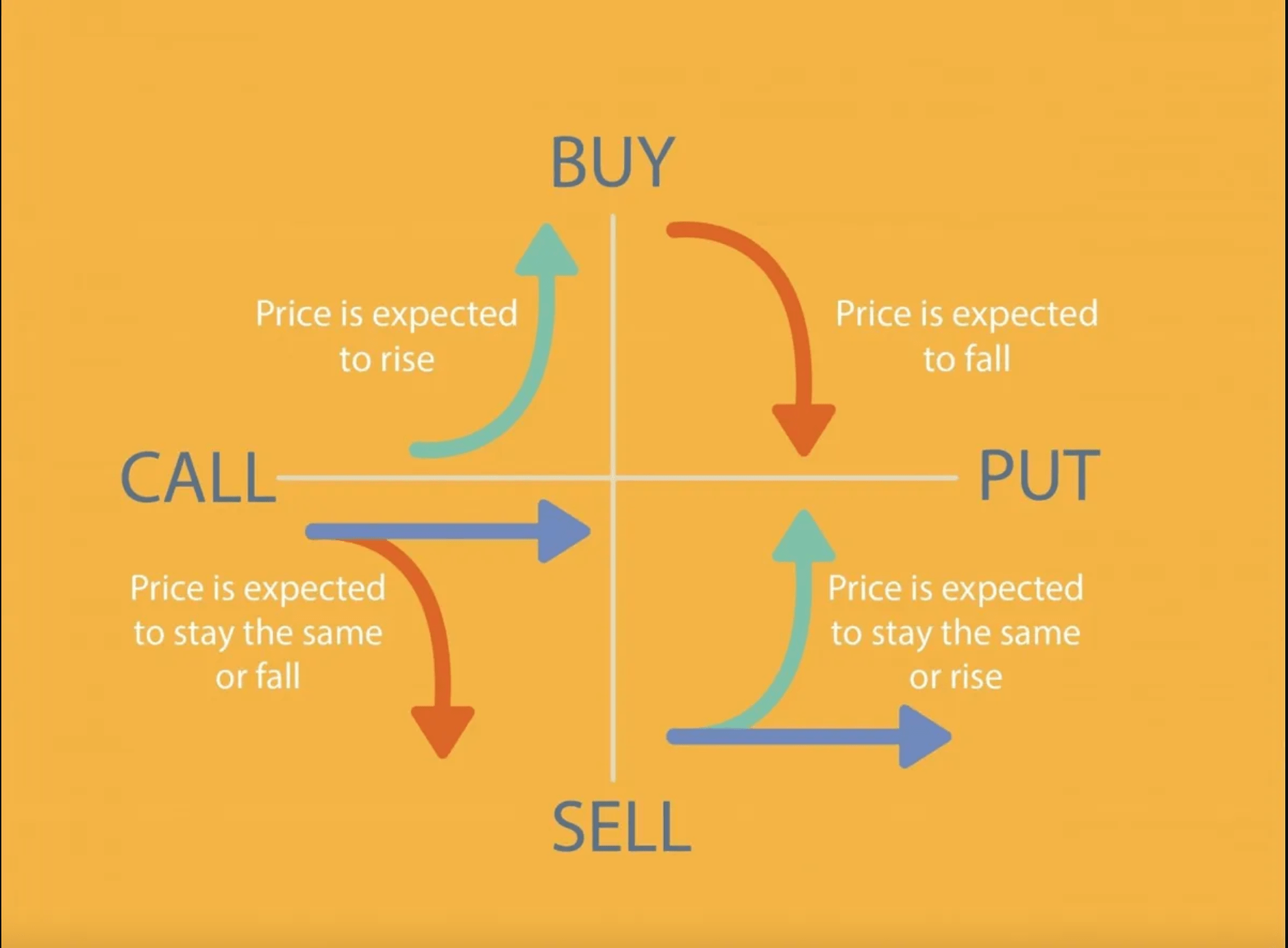

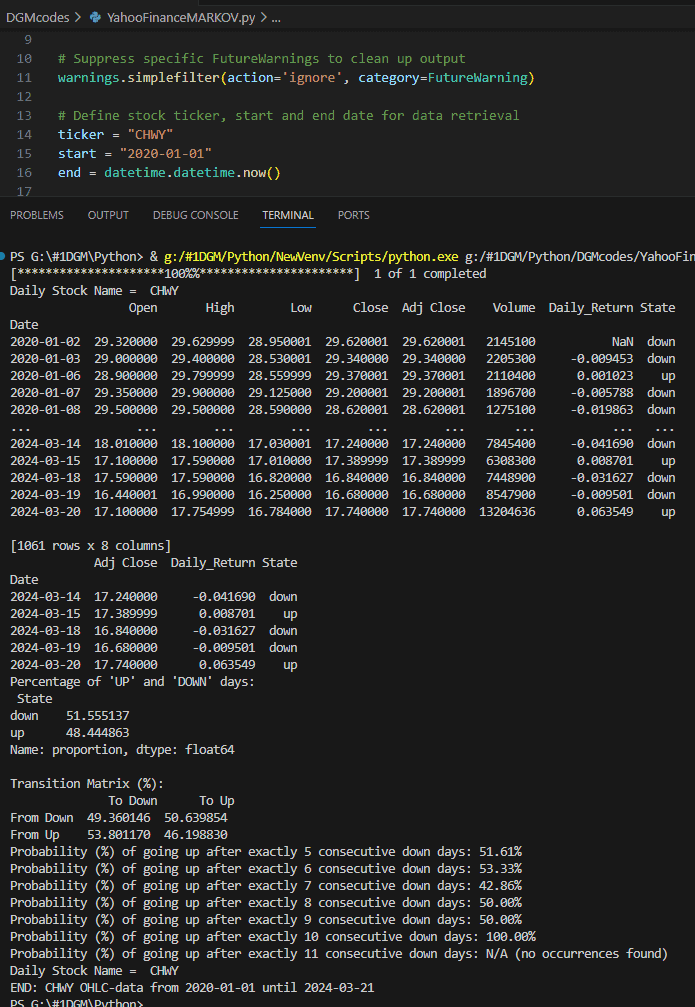

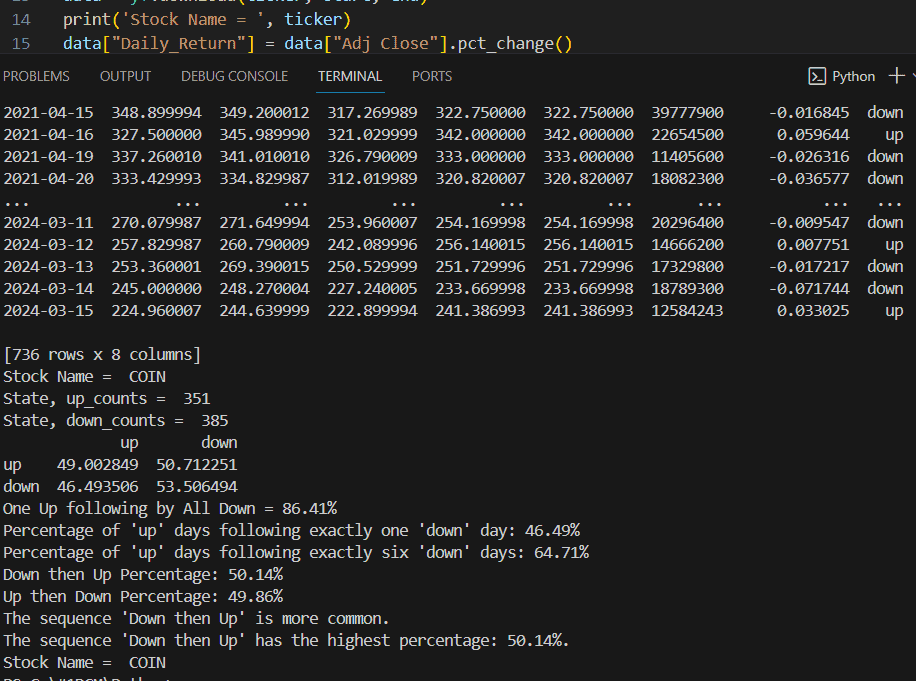

Analyzing any USA stocks with python codes. We can understand the sentiment much better,,, The Markov analysis process involves defining the likelihood of a future action, given the current state of a variable. Once the probabilities of future actions at each state are determined, a decision tree can be drawn, and the likelihood of a result can be calculated.

To predict the sequence probability and frequency in the past data set. In game theory, a Markov strategy is one that depends only on state variables that summarize the history of the game in one way or another. For instance, a state variable can be the current play in a repeated game, or it can be any interpretation of a recent sequence of play.

In 1993, Buffett spoke to Columbia University’s Business School graduates. Asked about his method for evaluating risk, he said, “Risk comes from not knowing what you’re doing.” This quote reflects Buffett’s investment philosophy, highlighting the crucial role of knowledge and understanding in reducing risk.

- Free VPN by Cloudflare (DNS)

- 3 SOP In Trading

- 2024 Building A Strong Heart With Quant Trading

- 2024 Building A Strong Heart With AI

- 2024 December Achievements

- Happy Achievements

Tips:

“The biggest risk is not taking any risk… In a world that changing really quickly, the only strategy that is guaranteed to fail is not taking risks.” Mark Zuckerberg ⬇️⬇️⬇️

Here To Trade Options From Experts With Best Wins And 100% FREE!!!

Yahoo Finance with MARKOV Strategy

Analyzing any USA stocks with python codes. We can understand the sentiment much better,,, The Markov analysis process involves defining the likelihood of a future action, given the current state of a variable. Once the probabilities of future actions at each state are determined, a decision tree can be drawn, and the likelihood of a result can be calculated.

To predict the sequence probability and frequency in the past data set. In game theory, a Markov strategy is one that depends only on state variables that summarize the history of the game in one way or another. For instance, a state variable can be the current play in a repeated game, or it can be any interpretation of a recent sequence of play.

A Regime Switching Model can help identify and switch between different market regimes, such as mean reversion (when prices tend to revert to a mean) and momentum trending (when prices follow a trend). One common approach to model such regimes is using a Markov Regime Switching Model (MRS), where the market can switch between different states (regimes) based on probabilities.

Here’s a guide on how you could implement this:

1. Define the Regimes:

- Mean Reversion: In this regime, prices fluctuate around a long-term mean. The idea is to buy when prices are below the mean and sell when they are above the mean.

- Momentum Trending: In this regime, prices tend to follow a trend. The strategy here is to go long during an uptrend and short during a downtrend.

2. Data Preparation:

- Collect historical price data (e.g., closing prices).

- Compute indicators that capture mean reversion and momentum behavior. Common indicators include:

- Mean Reversion: Moving average (MA), Bollinger Bands, Z-Score.

- Momentum: Moving Average Convergence Divergence (MACD), Relative Strength Index (RSI), trend-based indicators.

3. Markov Regime Switching Model:

- The Markov model assumes that the market can be in one of two or more regimes, with a certain probability of switching between them.

- The key parameters are the transition probabilities between regimes and the characteristics (e.g., mean, variance) of returns in each regime.

Steps to Implement:

- Model the Log Returns: Use log returns of the asset prices to model changes. These will serve as the inputs to the regime switching model.

- Define Two Regimes:

- Regime 1: Mean-reversion behavior.

- Regime 2: Momentum/trending behavior.

- Fit the Model: Use a package like

statsmodelsin Python to fit the Markov Regime Switching Model. Here’s an example usingMarkovAutoregression:

import numpy as np

import pandas as pd

from statsmodels.tsa.regime_switching.markov_regression import MarkovRegressionExample of fitting Markov Regime Switching model to stock returns

Generate log returns from price data

prices = pd.Series([100, 102, 104, 103, 102, 106, 108, 110, 112])

log_returns = np.log(prices / prices.shift(1)).dropna()Fit Markov Switching model

model = MarkovRegression(log_returns, k_regimes=2, trend=’c’, switching_variance=True)

results = model.fit()Print summary

print(results.summary())

Predict the regime at each time step

regimes = results.smoothed_marginal_probabilities[0] # Regime probabilities

print(regimes)

This code fits a two-regime Markov switching model to the log returns. The results object contains the parameters and probabilities of being in each regime over time.

4. Interpreting the Results:

- Regime 1: This could represent the mean-reversion regime, where prices tend to revert to their mean.

- Regime 2: This could represent the momentum-trending regime, where prices exhibit directional trends.

The model estimates the probability of being in each regime at each time step, allowing you to determine whether the market is in a mean-reversion or momentum-trending state.

5. Strategy Implementation:

- When in Mean Reversion (Regime 1):

- If the price is below the mean (using indicators like moving averages), go long.

- If the price is above the mean, go short.

- When in Momentum (Regime 2):

- Buy when the trend is upward and sell when the trend is downward.

6. Backtesting and Optimization:

- Backtest the strategy by switching between the two regimes based on the predicted probabilities.

- Fine-tune your indicators, such as the length of the moving averages or momentum indicators, to optimize performance.

Libraries to Consider:

statsmodelsfor regime-switching models.hmmlearnfor Hidden Markov Models, which is an alternative approach.

By switching between the two regimes based on the probabilities from the regime-switching model, you can potentially capture the market’s mean-reverting or trending behavior at the right time.

“The biggest risk is not taking any risk… In a world that changing really quickly, the only strategy that is guaranteed to fail is not taking risks.” Mark Zuckerberg

- Free VPN by Cloudflare (DNS)

- 3 SOP In Trading

- 2024 Building A Strong Heart With Quant Trading

- 2024 Building A Strong Heart With AI

- 2024 December Achievements

- Happy Achievements

In 1993, Buffett spoke to Columbia University’s Business School graduates. Asked about his method for evaluating risk, he said, “Risk comes from not knowing what you’re doing.” This quote reflects Buffett’s investment philosophy, highlighting the crucial role of knowledge and understanding in reducing risk.

Tips:

Despite of the crypto dump recently on all the alt coins after SEC announcement to sue Binance and Coinbase. Guess what? My Ai Trading Strategies are making shit ton of USDT from the crazy markets. Well there is a secret and cannot tell you unless…Anyway, I have given you the formula to copy and it is up to you to trade manually with stress and sleepless nights or ride on the trend of Ai trading today ⬇️⬇️⬇️

AI Sleeping Income With DGM System

The SECRET is to marry between Ai trading strategies and an income generated exchange platform

- Ai trading strategies

- An income generated exchange platform

How It Works?

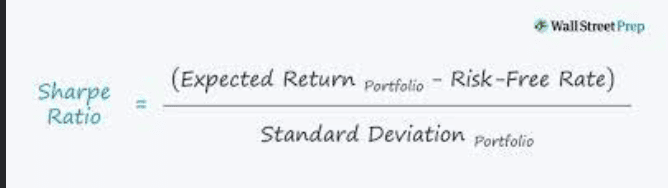

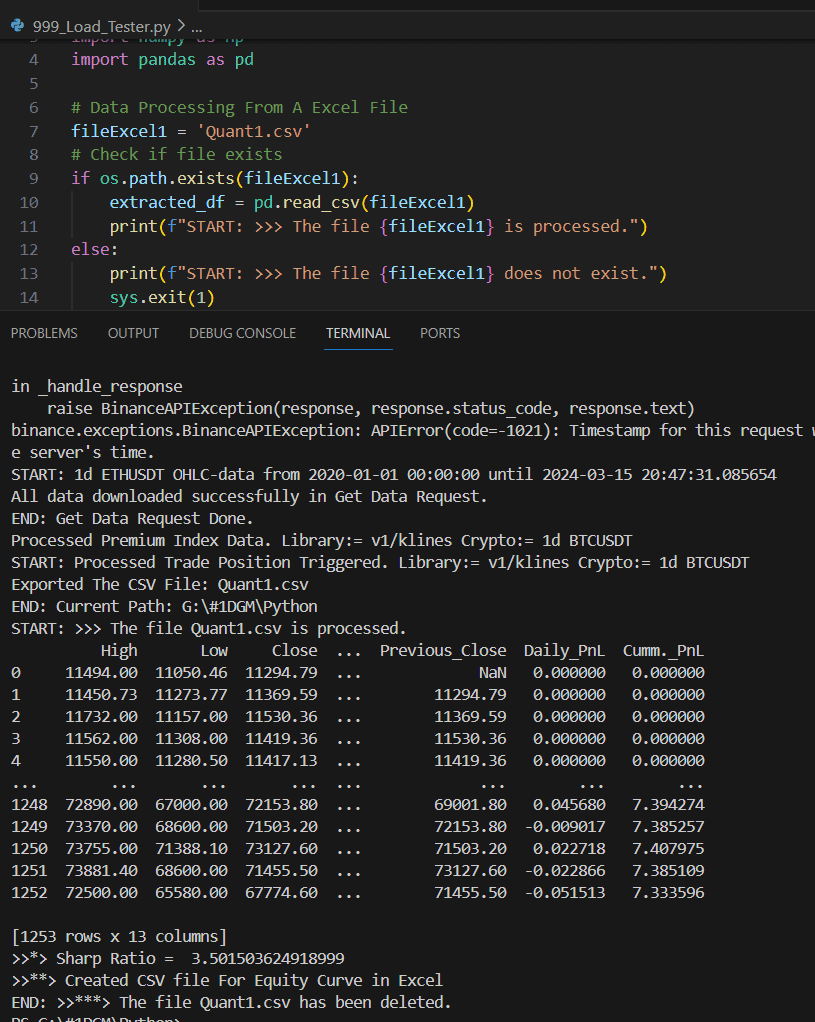

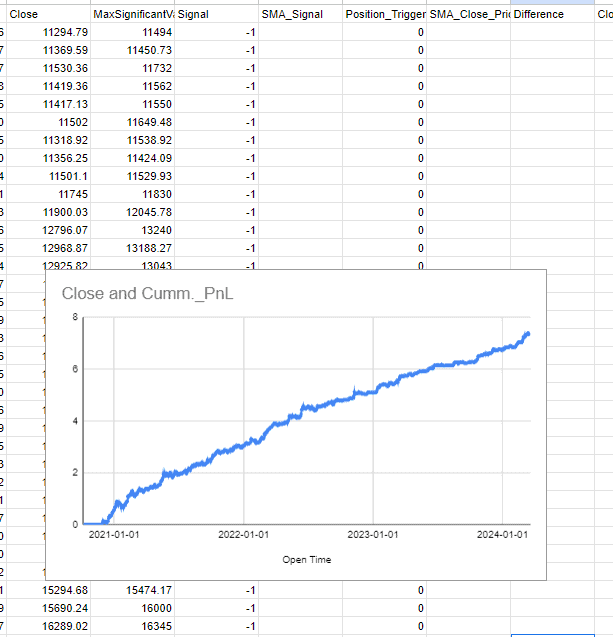

DGM-Sharp-Ratio-March 2024

Never before this is reviewed by Jim Simon

DGM Sharp Ratio = 3.5015 and Winning rate = 73.33596%

In 1993, Buffett spoke to Columbia University’s Business School graduates. Asked about his method for evaluating risk, he said, “Risk comes from not knowing what you’re doing.” This quote reflects Buffett’s investment philosophy, highlighting the crucial role of knowledge and understanding in reducing risk.

“The biggest risk is not taking any risk… In a world that changing really quickly, the only strategy that is guaranteed to fail is not taking risks.” Mark Zuckerberg

- Free VPN by Cloudflare (DNS)

- 3 SOP In Trading

- 2024 Building A Strong Heart With Quant Trading

- 2024 Building A Strong Heart With AI

- 2024 December Achievements

- Happy Achievements

Tips:

Despite of the crypto dump recently on all the alt coins after SEC announcement to sue Binance and Coinbase. Guess what? My Ai Trading Strategies are making shit ton of USDT from the crazy markets. Well there is a secret and cannot tell you unless…Anyway, I have given you the formula to copy and it is up to you to trade manually with stress and sleepless nights or ride on the trend of Ai trading today ⬇️⬇️⬇️

AI Sleeping Income With DGM System

The SECRET is to marry between Ai trading strategies and an income generated exchange platform

- Ai trading strategies

- An income generated exchange platform

How It Works?

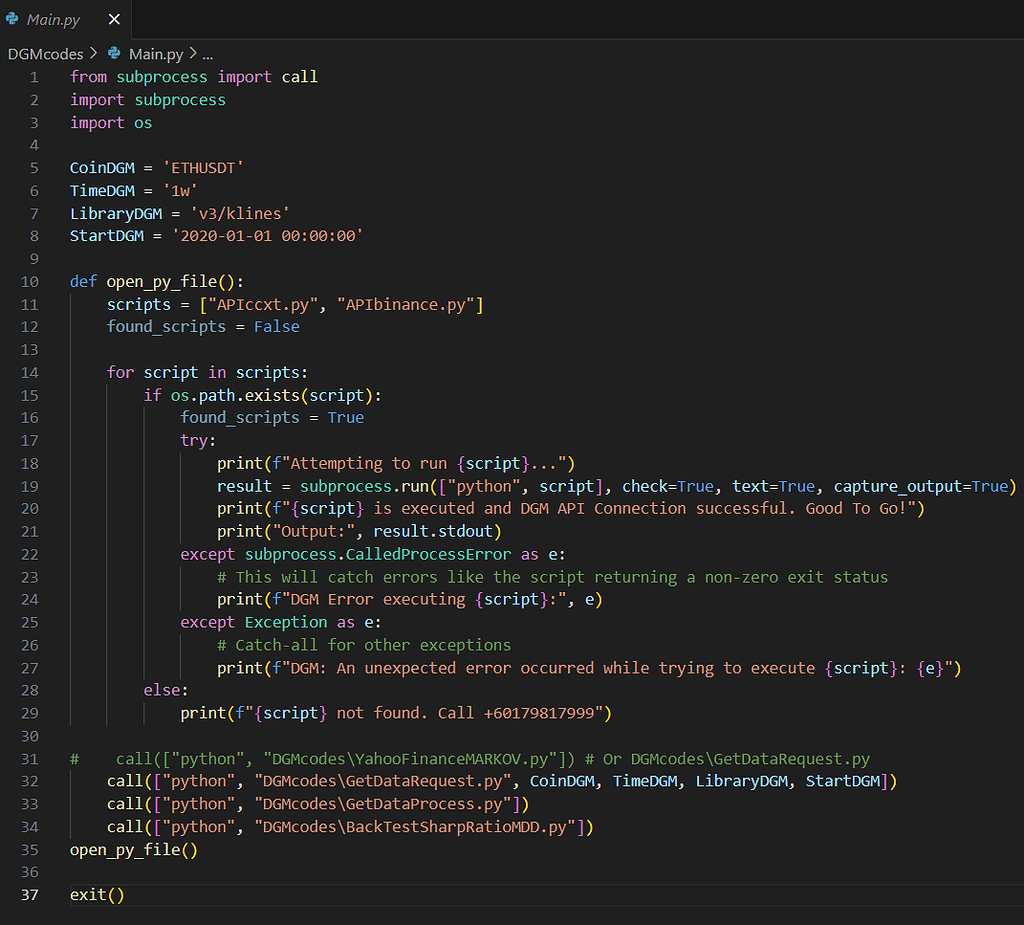

Properly Load & Manage API Keys in Python

- Free VPN by Cloudflare (DNS)

- 3 SOP In Trading

- 2024 Building A Strong Heart With Quant Trading

- 2024 Building A Strong Heart With AI

- 2024 December Achievements

- Happy Achievements

Tips:

Despite of the crypto dump recently on all the alt coins after SEC announcement to sue Binance and Coinbase. Guess what? My Ai Trading Strategies are making shit ton of USDT from the crazy markets. Well there is a secret and cannot tell you unless…Anyway, I have given you the formula to copy and it is up to you to trade manually with stress and sleepless nights or ride on the trend of Ai trading today ⬇️⬇️⬇️

AI Sleeping Income With DGM System

The SECRET is to marry between Ai trading strategies and an income generated exchange platform

- Ai trading strategies

- An income generated exchange platform

How It Works?

Stock Market Crash Lesson Learned

This is a good note as moving forward for the DGM family.

- Free VPN by Cloudflare (DNS)

- 3 SOP In Trading

- 2024 Building A Strong Heart With Quant Trading

- 2024 Building A Strong Heart With AI

- 2024 December Achievements

- Happy Achievements

Tips:

Despite of the crypto dump recently on all the alt coins after SEC announcement to sue Binance and Coinbase. Guess what? My Ai Trading Strategies are making shit ton of USDT from the crazy markets. Well there is a secret and cannot tell you unless…Anyway, I have given you the formula to copy and it is up to you to trade manually with stress and sleepless nights or ride on the trend of Ai trading today ⬇️⬇️⬇️

AI Sleeping Income With DGM System

The SECRET is to marry between Ai trading strategies and an income generated exchange platform

- Ai trading strategies

- An income generated exchange platform

How It Works?

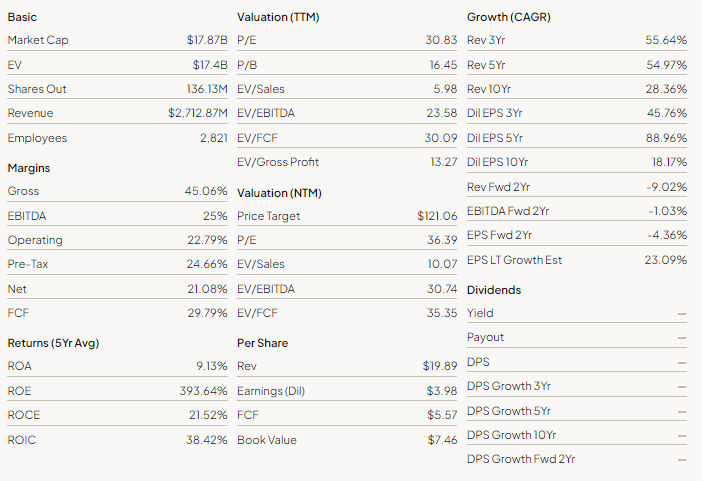

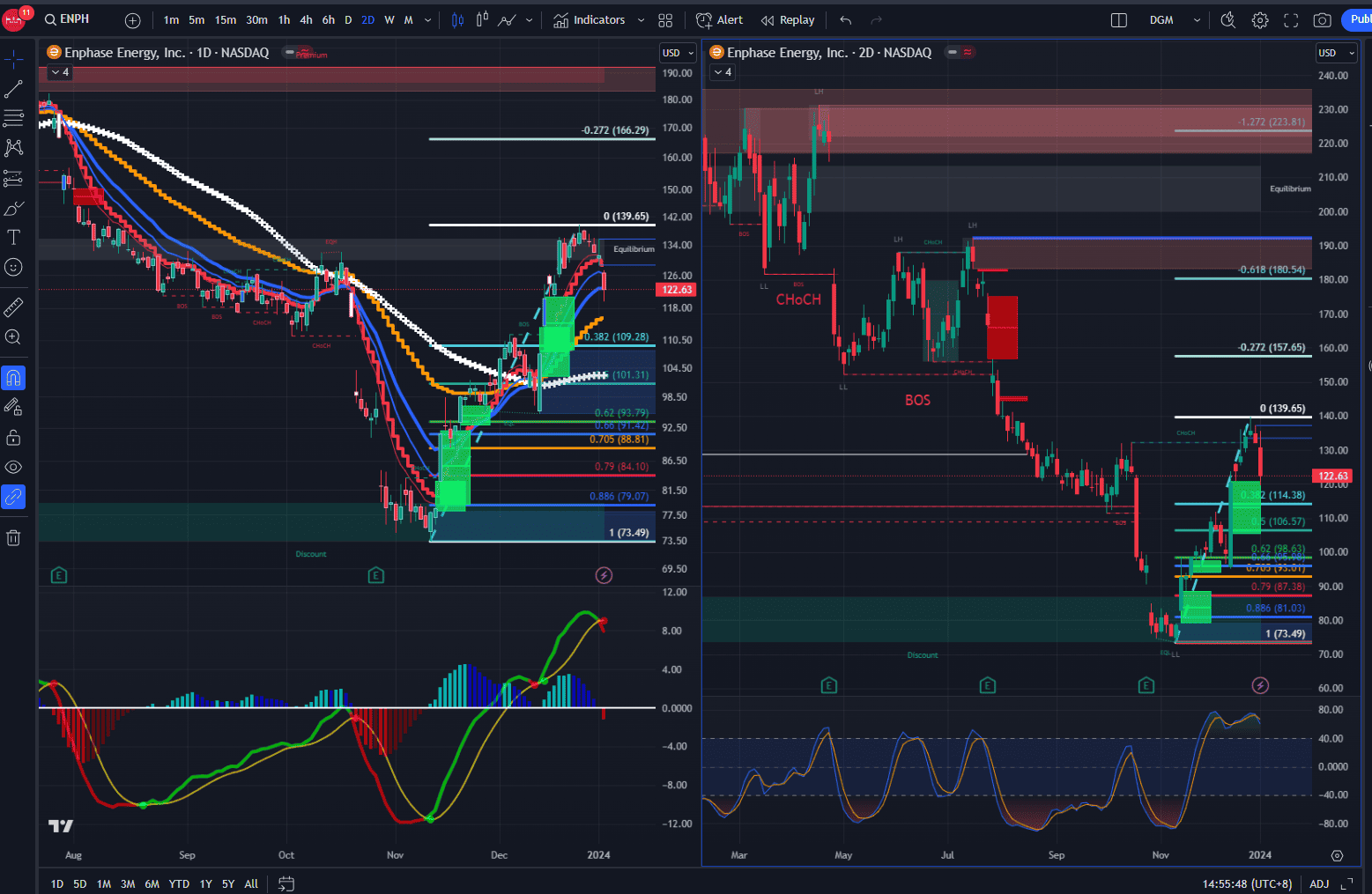

Options in ENPH or PLTR This Month?

ENPH?

PLTR?

Which one to trade and invest this month? Please feel free to give your comments…

Alternatively, you can join me for free but with limited resources:

Here To Trade Options From Experts With Best Wins And 100% FREE!!!

Options/Crypto AI Trading @DailyGameMoments (DGM)

Who Is DGM:

My DGM Story:

From an online gamer to a fintech trader. Have been trading in forex for more than 20 years and started my full swing investment journey about 5 years ago. Daily, I spend few hours working on my existing trades in options and crypto or forex. So, it didn’t take me long to realise that I could make everyone’s lives easier by putting an angel investment network plan together about Options/Crypto AI Trading @DailyGameMoments in one place.

从在线游戏玩家到金融科技交易员。从事外汇交易已有 20 多年,大约 5 年前开始了我全面的投资之旅。每天,我都会花几个小时处理现有的期权、加密货币或外汇交易。因此,没过多久我就意识到,通过将有关期权/加密货币 AI 交易 @DailyGameMoments 的天使投资网络计划放在一个地方,我可以让每个人的生活变得更轻松。

This is that place.

这就是那个地方.

Looking for early adopters and investors for joining DGM on the journey of the most cutting edge fintech solution in trading and investment AI. The target amount to raise is $30K USD.

寻找早期采用者和投资者加入 DGM,踏上交易和投资人工智能领域最前沿的金融科技解决方案的旅程。筹集的目标金额为 3 万美元。

The same information can be found in the public domain of angel investment network:

Alternatively, you can join me for free but with limited resources:

Here To Trade Options From Experts With Best Wins And 100% FREE!!!

Heiken Ashi With EMA

- Free VPN by Cloudflare (DNS)

- 3 SOP In Trading

- 2024 Building A Strong Heart With Quant Trading

- 2024 Building A Strong Heart With AI

- 2024 December Achievements

- Happy Achievements

Tips:

Despite of the crypto dump recently on all the alt coins after SEC announcement to sue Binance and Coinbase. Guess what? My Ai Trading Strategies are making shit ton of USDT from the crazy markets. Well there is a secret and cannot tell you unless…Anyway, I have given you the formula to copy and it is up to you to trade manually with stress and sleepless nights or ride on the trend of Ai trading today ⬇️⬇️⬇️

AI Sleeping Income With DGM System

The SECRET is to marry between Ai trading strategies and an income generated exchange platform

- Ai trading strategies

- An income generated exchange platform