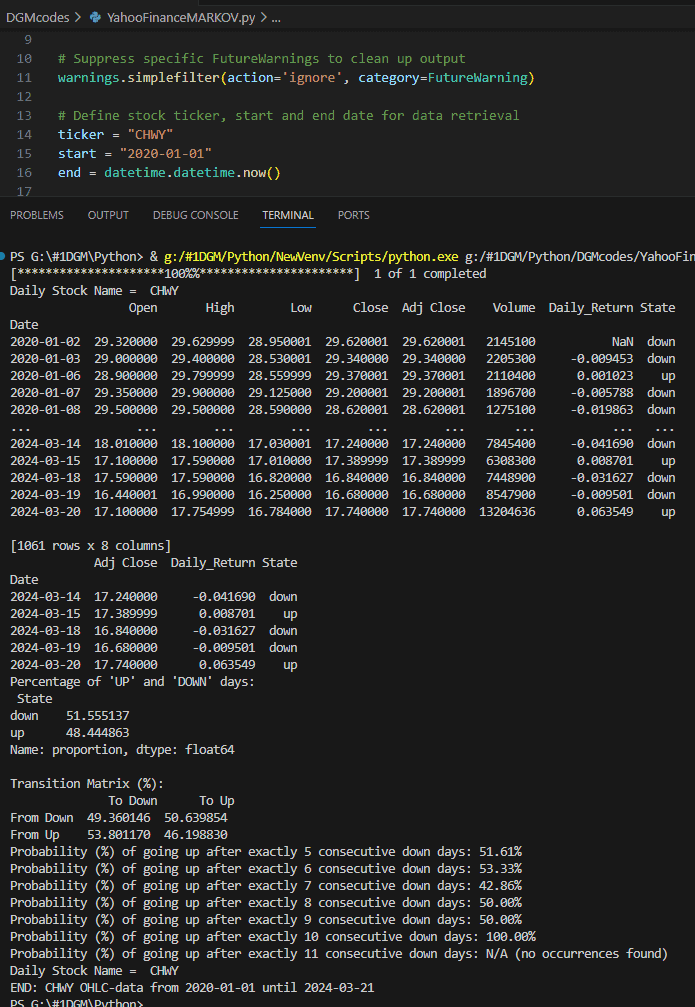

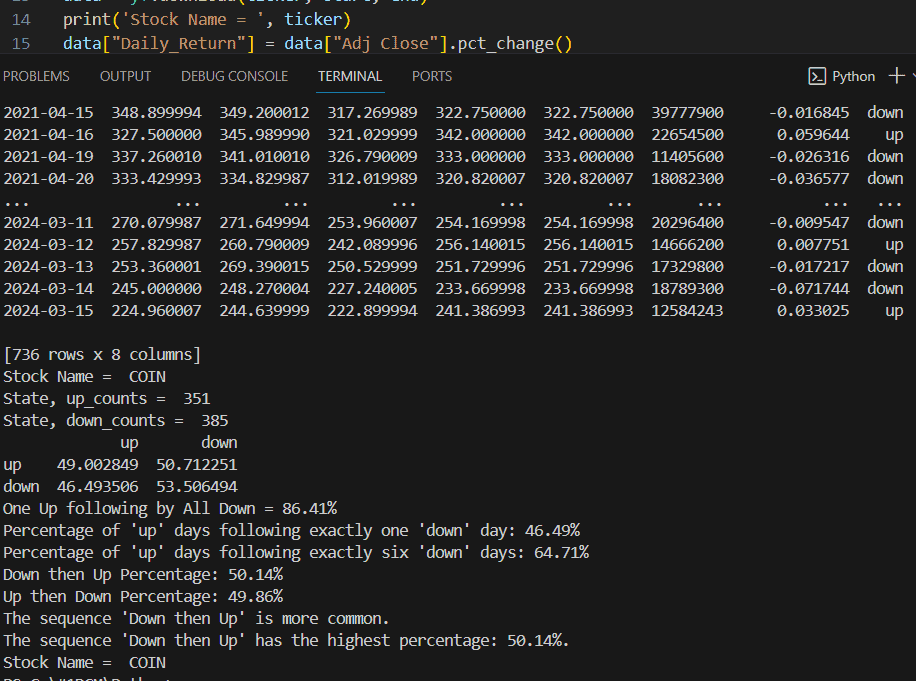

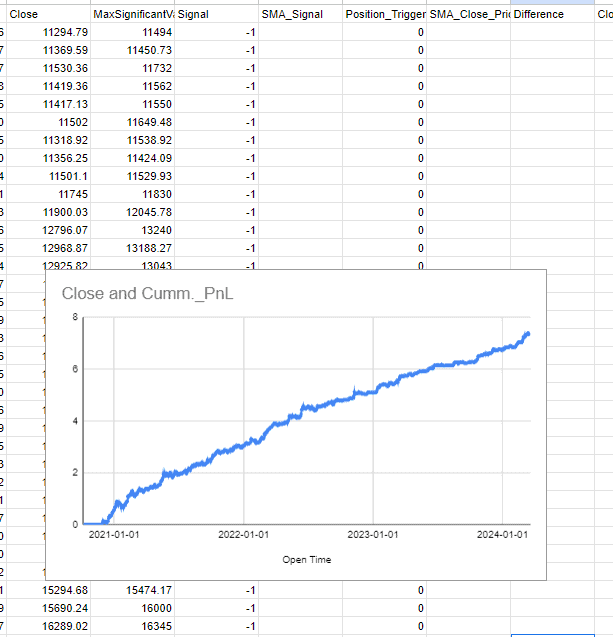

Which time frame performing the best result after some back testing?

fastEMA:30 slowEMA:50 SOLUSDT SL=2.5, TP=1.8, return=13.29% in 1h.

fastEMA:30 slowEMA:50 SOLUSDT SL=2.5, TP=1.3, return=4.96% in 30m.

fastEMA:30 slowEMA:50 SOLUSDT SL=1.2, TP=1.1, return=-1.01% in 15m.

fastEMA:30 slowEMA:50 SOLUSDT SL=1.5, TP=2.5, return=-0.42% in 5m.

fastEMA:30 slowEMA:50 SOLUSDT SL=1.1, TP=1.4, return=0.66% in 4h.

fastEMA:20 slowEMA:40 SOLUSDT SL=2.4, TP=2.2, return=6.70% in 1h.

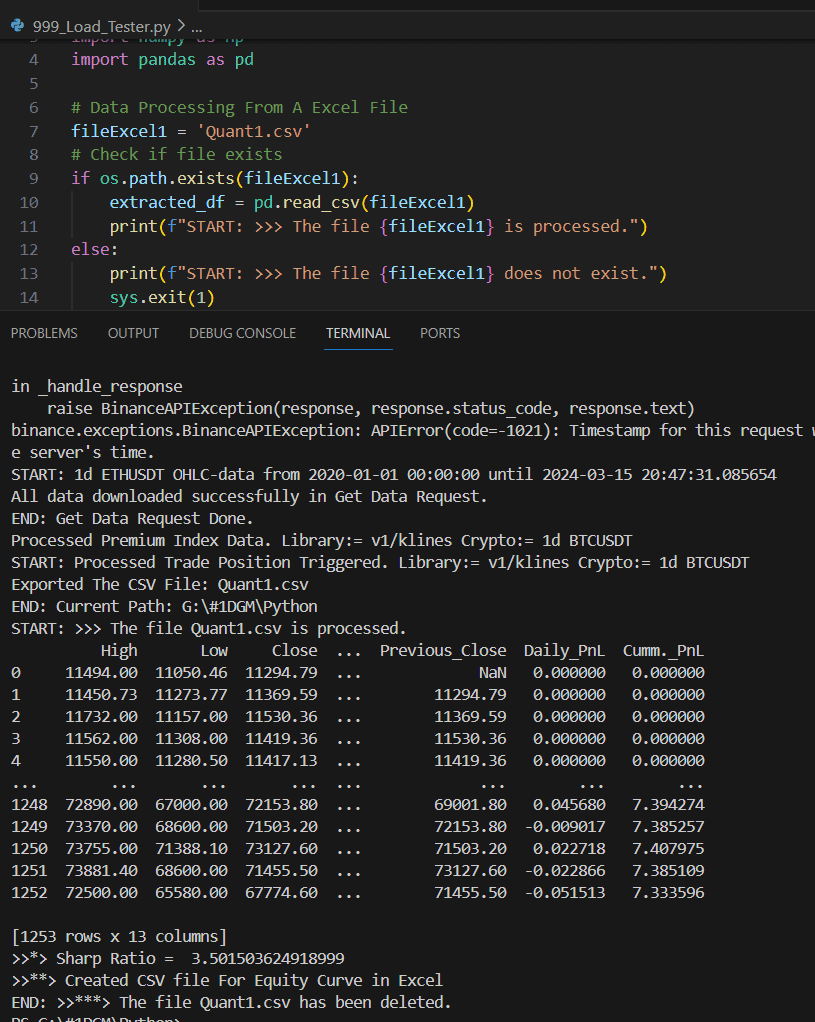

fastEMA:50 slowEMA:100 SOLUSDT SL=2.0, TP=2.5, return=8.82% in 1h.fastEMA:30 slowEMA:50 ETHUSDT SL=2.1, TP=2.4, return=10.72% in 1h.

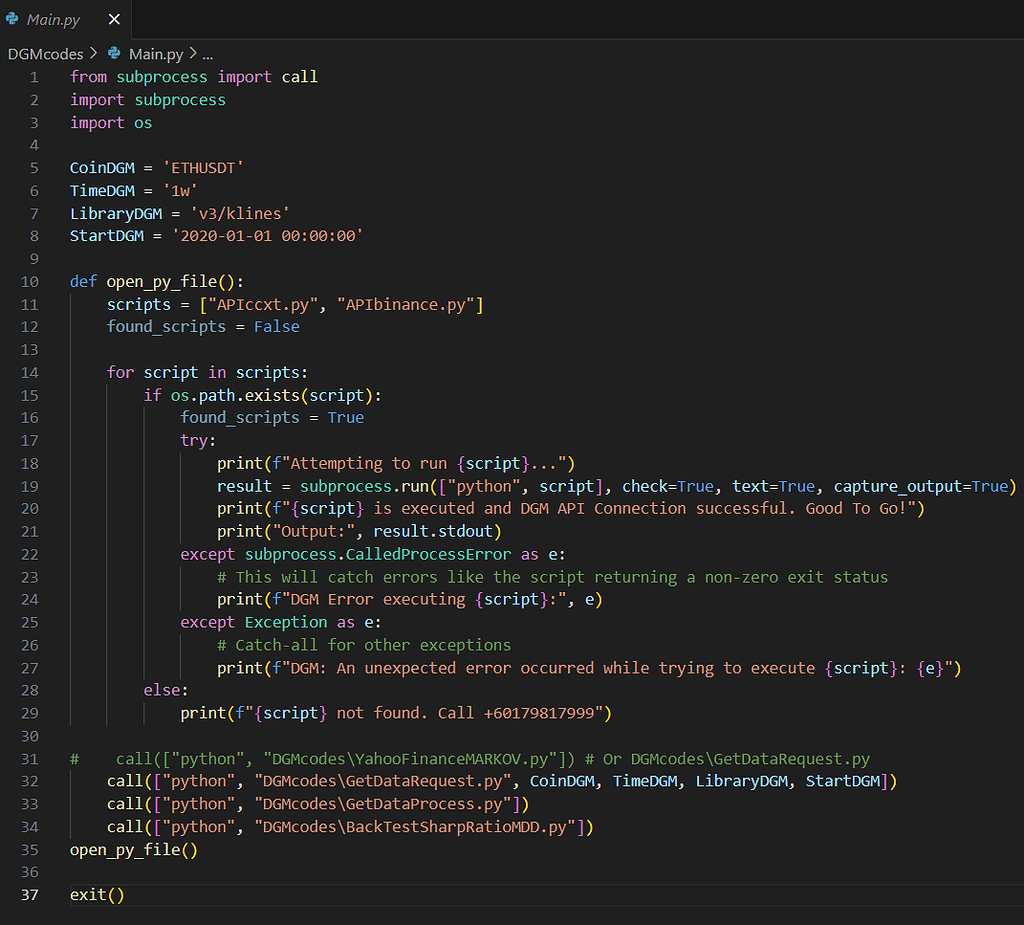

def count_opened_trades():

fastEMA:30 slowEMA:50 ETHUSDT SL=1.8, TP=1.3, return=1.06% in 30m.

fastEMA:30 slowEMA:50 ETHUSDT SL=1.1, TP=1.7, return=0.10% in 15m.

fastEMA:30 slowEMA:50 ETHUSDT SL=1.3, TP=2.5, return=0.69% in 5m.

fastEMA:30 slowEMA:50 ETHUSDT SL=1.0, TP=1.3, return=3.97% in 4h.

fastEMA:20 slowEMA:40 ETHUSDT SL=2.2, TP=2.4, return=9.95% in 1h.

fastEMA:50 slowEMA:100 ETHUSDT SL=1.3, TP=2.5, return=-2.24% in 1h.

api_instance = c.API(access_token)

config = api_instance.config

api_key = config.get(“api_key_bybit”)

api_secret = config.get(“api_secret_bybit”)

session = HTTP(testnet=False, api_key=api_key, api_secret=api_secret)

try:

data = session.get_positions(category=”linear”, symbol=Symbol)

size = data[‘result’][‘list’][0][‘size’]

return float(size)

except Exception as e:

print(f”DGM Failed to get {Symbol} position: {e}”)

return

def ema_signal(df, current_candle, backcandles):

df_slice = df.reset_index().copy()

start = max(0, current_candle – backcandles)

end = current_candle + 1

relevant_rows = df_slice.iloc[start:end]

# Check if all EMA_fast values are below EMA_slow values (buy signal)

if (relevant_rows[‘EMA_fast’] < relevant_rows[‘EMA_slow’]).all():

return 1

# Check if all EMA_fast values are above EMA_slow values (sell signal)

elif (relevant_rows[‘EMA_fast’] > relevant_rows[‘EMA_slow’]).all():

return -1

else:

return 0

def total_signal(df, current_candle, backcandles):

if isinstance(current_candle, pd.Timestamp):

current_candle = df.index.get_loc(current_candle)

ema_signal_result = ema_signal(df, current_candle, backcandles)

candle_open_price = df[‘Open’].iloc[current_candle]

bbl = df[‘BBL_15_1.5’].iloc[current_candle]

bbu = df[‘BBU_15_1.5’].iloc[current_candle]

if ema_signal_result == 1 and candle_open_price <= bbl:

return 1

if ema_signal_result == -1 and candle_open_price >= bbu:

return -1

return 0

def get_candles(symbol, interval, lookback):

url = f”{API_URLv3}{library}?symbol={symbol}&interval={interval}&limit={lookback}”

try:

response = requests.get(url)

response.raise_for_status()

data = response.json()

if not data:

print(f”No data received from {API_URLv3}{library} API.”)

return None

df = pd.DataFrame(data, columns=[

‘open_time’, ‘open’, ‘high’, ‘low’, ‘close’, ‘volume’,

‘close_time’, ‘quote_asset_volume’, ‘number_of_trades’,

‘taker_buy_base_asset_volume’, ‘taker_buy_quote_asset_volume’, ‘ignore’

])

df[‘open_time’] = pd.to_datetime(df[‘open_time’], unit=’ms’)

df.set_index(‘open_time’, inplace=True)

df.rename(columns={‘open’: ‘Open’, ‘high’: ‘High’, ‘low’: ‘Low’, ‘close’: ‘Close’}, inplace=True)

df[[‘Open’, ‘High’, ‘Low’, ‘Close’]] = df[[‘Open’, ‘High’, ‘Low’, ‘Close’]].astype(float)

return df[[‘Open’, ‘High’, ‘Low’, ‘Close’]]

except requests.RequestException as e:

print(f”{symbol} Request failed: {e}”)

except Exception as e:

print(f”Failed to process {symbol} data: {e}”)

return None

def get_candles_frame(lookback):

candles = get_candles(Symbol, Interval, lookback)

if candles is None:

print(f”Failed to retrieve {Interval} {Symbol} candle data.”)

return None

dfstream = candles.copy()

dfstream[‘ATR’] = ta.atr(dfstream[‘High’], dfstream[‘Low’], dfstream[‘Close’], length=7)

dfstream[‘EMA_fast’] = ta.ema(dfstream[‘Close’], length=30)

dfstream[‘EMA_slow’] = ta.ema(dfstream[‘Close’], length=50)

dfstream[‘RSI’] = ta.rsi(dfstream[‘Close’], length=10)

my_bbands = ta.bbands(dfstream[‘Close’], length=15, std=1.5)

dfstream = dfstream.join(my_bbands)

if not isinstance(dfstream.index, pd.DatetimeIndex):

dfstream.index = pd.to_datetime(dfstream.index)

dfstream[‘TotalSignal’] = dfstream.apply(lambda row: total_signal(dfstream, row.name, 7), axis=1)

dfstream.to_csv(‘dfstream.csv’)

return dfstream

def optimization():

slatrcoef = 0

TPSLRatio_coef = 0

dfstream = get_candles_frame(lookback)

if dfstream is None:

print(f”No candle data for {Symbol} fitting optimization job.”)

return

def SIGNAL():

return dfstream[‘TotalSignal’]

class MyStrat(Strategy):

mysize = 3000

slcoef = 1.3

TPSLRatio = 2.5

def init(self):

self.signal1 = self.I(SIGNAL)

def next(self):

slatr = self.slcoef * self.data.ATR[-1]

TPSLRatio = self.TPSLRatio

if self.signal1[-1] == 2 and len(self.trades) == 0:

sl1 = self.data.Close[-1] – slatr

tp1 = self.data.Close[-1] + slatr * TPSLRatio

self.buy(sl=sl1, tp=tp1, size=self.mysize)

elif self.signal1[-1] == 1 and len(self.trades) == 0:

sl1 = self.data.Close[-1] + slatr

tp1 = self.data.Close[-1] – slatr * TPSLRatio

self.sell(sl=sl1, tp=tp1, size=self.mysize)

bt = Backtest(dfstream, MyStrat, cash=100000, margin=0.01, commission=0.00055)

stats, heatmap = bt.optimize(slcoef=[i/10 for i in range(10, 26)],

TPSLRatio=[i/10 for i in range(10, 26)],

maximize=’Return [%]’, max_tries=300,

random_state=0,

return_heatmap=True)

print(stats)

slatrcoef = stats[“_strategy”].slcoef

TPSLRatio_coef = stats[“_strategy”].TPSLRatio

print(f”{Symbol} SL = {slatrcoef}, TP = {TPSLRatio_coef}, expected return, {stats[‘Return [%]’]:.2f}% in {Interval} interval.\n”)

with open(“fitting_data_file.txt”, “a”) as file:

file.write(f”{Symbol} SL = {slatrcoef}, TP = {TPSLRatio_coef}, expected return, {stats[‘Return [%]’]:.2f}% in {Interval} interval.\n”)

return slatrcoef, TPSLRatio_coef

def trading_job():

dfstream = get_candles_frame(lookback)

if dfstream is None:

print(f”No {Symbol} candle data for trading job.”)

return

signal = total_signal(dfstream, len(dfstream) – 1, 7)

# now = datetime.now()

# if now.weekday() == 0 and now.hour < 7 and now.minute < 5: # Monday before 07:05

slatrcoef, TPSLRatio_coef = optimization()

print(f”Optimize SL = {slatrcoef}, and TP = {TPSLRatio_coef}.”)

slatr = slatrcoef * dfstream[‘ATR’].iloc[-1]

TPSLRatio = TPSLRatio_coef

max_spread = 16e-5

last_candle = get_candles(Symbol, Interval, 1).iloc[-1]

candle_open_bid = float(last_candle[‘Open’])

candle_open_ask = candle_open_bid

spread = candle_open_ask – candle_open_bid

SLBuy = candle_open_bid – slatr – spread

SLSell = candle_open_ask + slatr + spread

TPBuy = candle_open_ask + slatr * TPSLRatio + spread

TPSell = candle_open_bid – slatr * TPSLRatio – spread

print(“SLBuy = “, SLBuy)

print(“SLSell = “, SLSell)

print(“TPBuy = “, TPBuy )

print(“TPSell = “, TPSell)

# # Sell

# if signal == -1 and count_opened_trades() == 0.0 and spread < max_spread:

# print(“Sell Signal Found…”)

# trade_crypto = c.TradeCrypto(EXCHANGE, Symbol, ‘sell’)

# message, MyTradePrice = trade_crypto.TradeQty(quantity)

# print(message)

# with open(“trading_data_file.txt”, “a”) as file:

# file.write(f”SL = {SLSell}, TP = {TPSell}, Trade Price = {MyTradePrice}\n”)

# # Buy

# elif signal == 1 and count_opened_trades() == 0.0 and spread < max_spread:

# print(“Buy Signal Found…”)

# trade_crypto = c.TradeCrypto(EXCHANGE, Symbol, ‘buy’)

# message, MyTradePrice = trade_crypto.TradeQty(quantity)

# print(message)

# with open(“trading_data_file.txt”, “a”) as file:

# file.write(f”SL = {SLBuy}, TP = {TPBuy}, Trade Price = {MyTradePrice}\n”)

if __name__ == “__main__”:

optimization()

# scheduler = BlockingScheduler()

# scheduler.add_job(trading_job, ‘cron’, day_of_week=’mon-fri’, hour=’07-18′, minute=’1, 6, 11, 16, 21, 26, 31, 36, 41, 46, 51, 56′, timezone=’Asia/Beirut’, misfire_grace_time=15)

# scheduler.start()

In 1993, Buffett spoke to Columbia University’s Business School graduates. Asked about his method for evaluating risk, he said, “Risk comes from not knowing what you’re doing.” This quote reflects Buffett’s investment philosophy, highlighting the crucial role of knowledge and understanding in reducing risk.

“The biggest risk is not taking any risk… In a world that changing really quickly, the only strategy that is guaranteed to fail is not taking risks.” Mark Zuckerberg

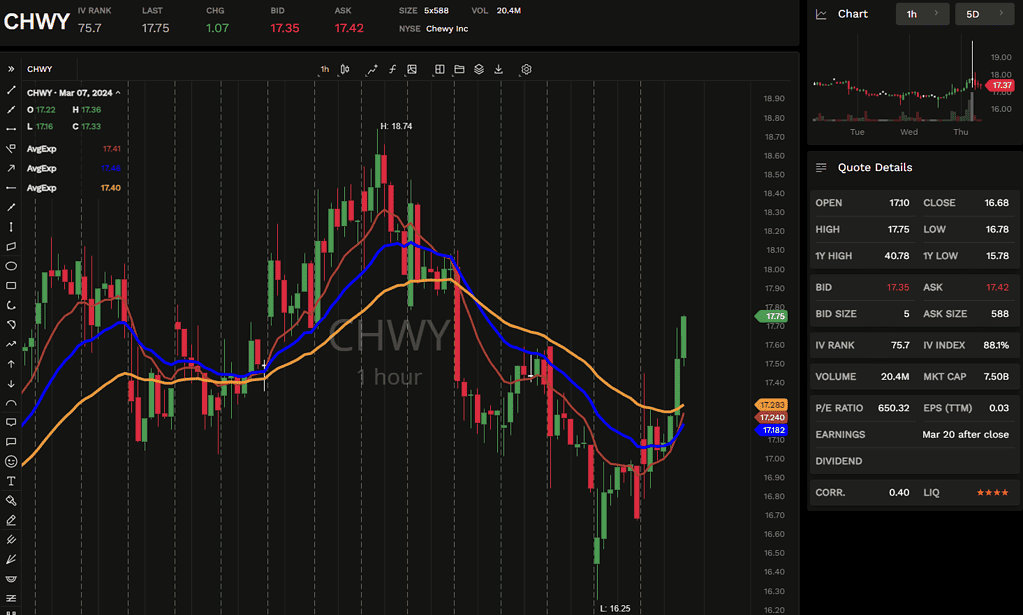

- Price Action EMA + RSI + Bollinger Bands With Bots Testing

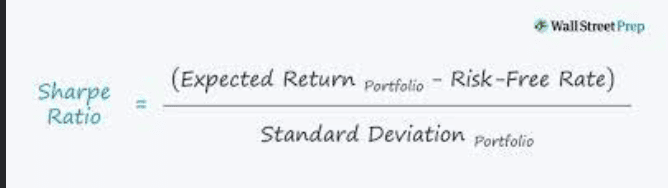

- BackTest Sharpe Ratio and Max Draw Down

- AI Strategies To Become A Millionaire

- DGM AI Testing Results

- DGM Candles Pattern Scanner

- DGM Technical Scanner

Tips:

Despite of the crypto dump recently on all the alt coins after SEC announcement to sue Binance and Coinbase. Guess what? My Ai Trading Strategies are making shit ton of USDT from the crazy markets. Well there is a secret and cannot tell you unless…Anyway, I have given you the formula to copy and it is up to you to trade manually with stress and sleepless nights or ride on the trend of Ai trading today ⬇️⬇️⬇️

AI Sleeping Income With DGM System

The SECRET is to marry between Ai trading strategies and an income generated exchange platform

- Ai trading strategies

- An income generated exchange platform